What Is Transfer In Tax Superannuation You won t be able to claim tax on super guarantee payment made by your employer as it is already taxed at a concession rate However you can claim tax deduction on

Unless you are commuting a super death benefit income stream you can choose to transfer the lump sum to an accumulation account or withdraw it from the superannuation Generally transfers to or from other super funds are not taxed However transfers from some government funds may include an untaxed element which may be subject to tax

What Is Transfer In Tax Superannuation

What Is Transfer In Tax Superannuation

https://researchonline.jcu.edu.au/15860/1/15860_Woellner_et_al_2011_Book_cover.jpg

:max_bytes(150000):strip_icc()/transferprice.asp_final-6b9648f512974b73bc464682d58a1dbe.png)

Transfer Pricing What It Is And How It Works With 55 OFF

https://www.investopedia.com/thmb/BLOiCorl8MtmT9_QCf1GEERcgLo=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/transferprice.asp_final-6b9648f512974b73bc464682d58a1dbe.png

Dr William Beecroft

https://cdn.sanity.io/images/eztzxh9q/production/d2a5e03081bd73af0e72dc6b831a85dab4a5fab7-628x627.jpg?w=1080&q=75&fit=clip&auto=format

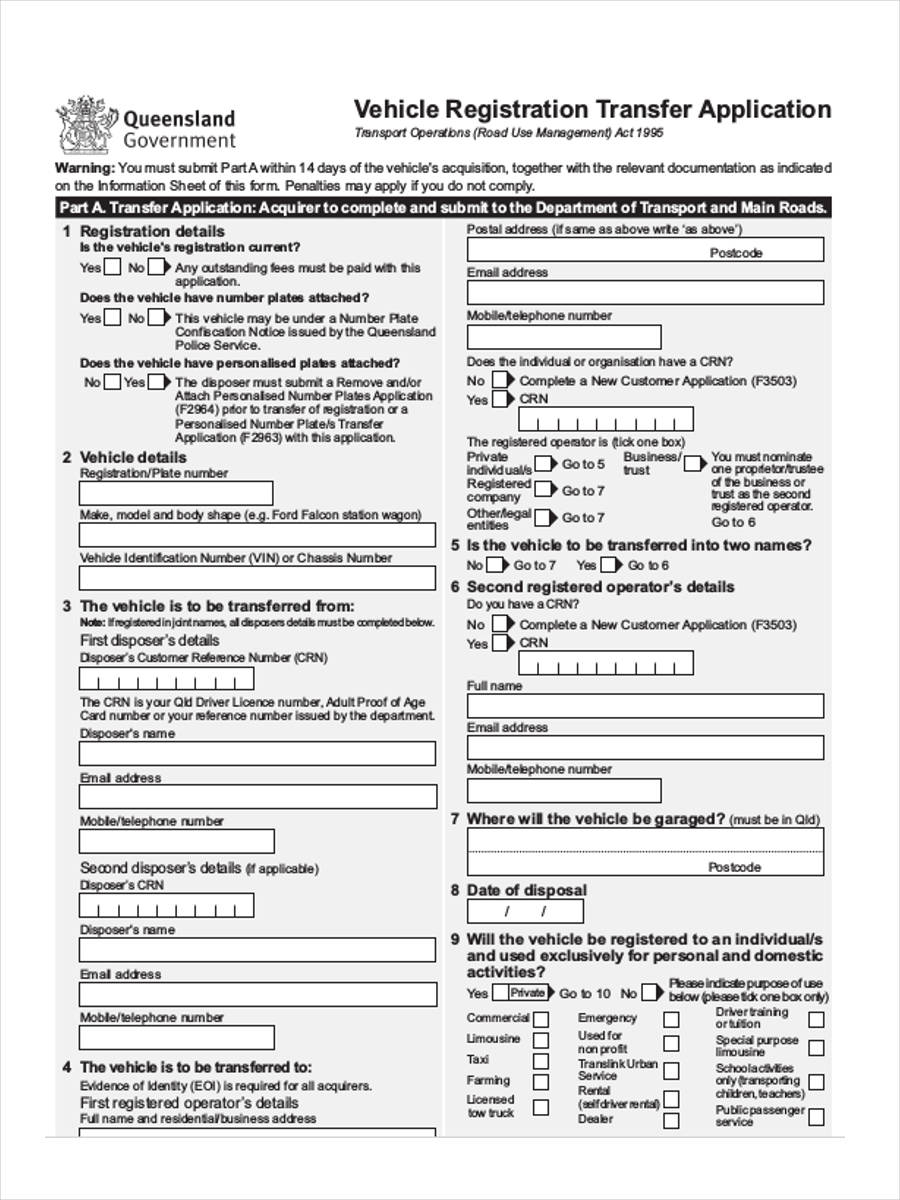

A rollover is when you as a member transfer some or all of your existing super between super funds including SMSFs It is a legal requirement for rollovers to be processed The transfer balance cap is relevant to the moment in time when your superannuation savings switch from being in accumulation to pension phase At that point in time an assessment is made comparing your superannuation

Interest from a superannuation fund is tax free On retirement 1 3 of the commuted fund is fully exempt from tax and the remaining amount if transferred to an annuity is tax The transfer balance cap limits the amount you can transfer from your super savings into a tax free pension The cap is currently 1 9m but you may have a different cap depending on when you started a pension

More picture related to What Is Transfer In Tax Superannuation

:max_bytes(150000):strip_icc()/Term-Definitions_transfer-pricing-49c8de8ae5a649849a48fbd9139dc8c2.png)

Pricing

https://www.investopedia.com/thmb/QtHeSaTILQnlwca2frjIaT_AeLM=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Term-Definitions_transfer-pricing-49c8de8ae5a649849a48fbd9139dc8c2.png

Check Superannuation Benefits In India Tax Benefits Under Income Tax Act

https://www.indiafilings.com/learn/wp-content/uploads/2018/03/Superannuation-Income-Tax.jpg

Tax Engagement Letter Sample With Examples Word Editable

https://i0.wp.com/templatediy.com/wp-content/uploads/2023/02/Tax-Engagement-Letter-Word.jpg?fit=1414%2C2000&ssl=1

As a Triple S or Super SA Select member you have the choice to transfer your super to another super fund If you are actively employed in the South Australian public sector you can choose to transfer part of your account balance or if Super withdrawals get divided into tax free and taxable components This depends on whether your contributions made were after tax or before tax contributions The amount of tax applied

What is a Superannuation Rollover A superannuation rollover occurs when you transfer your super balance from one fund to another This process can arise when Superannuation earnings become completely tax free during retirement phase though the transfer balance cap applies This cap sets limits on amounts you can transfer into tax free

2025 Tax Slabs Usa Miles Yusuf

https://assets1.cleartax-cdn.com/finfo/wg-utils/retool/c783e14b-0e27-4b10-a784-40bd925acdda.png

Tax Brackets 2025 25 Richard D Hart

https://images.prismic.io/payfit/4a90d271-43c6-4dcf-834a-53fa79bb3a33_UK+tax+rates.png?auto=compress,format&rect=0,0,642,406&w=2429&h=1536

https://community.ato.gov.au › question

You won t be able to claim tax on super guarantee payment made by your employer as it is already taxed at a concession rate However you can claim tax deduction on

:max_bytes(150000):strip_icc()/transferprice.asp_final-6b9648f512974b73bc464682d58a1dbe.png?w=186)

https://www.ato.gov.au › ... › transfer-balance-account

Unless you are commuting a super death benefit income stream you can choose to transfer the lump sum to an accumulation account or withdraw it from the superannuation

Vehicle Registration Transfer Application Form TransferForm

2025 Tax Slabs Usa Miles Yusuf

Email Address Australian Super

Inmate Transfer Request Letter Sample Template With Example

Tax Rates 2025 25 Uk 2025 James Aadil

CrewAI A Guide With Examples Of Multi AI Agent Systems DataCamp

CrewAI A Guide With Examples Of Multi AI Agent Systems DataCamp

How To Write A Resume As A Transfer Student

Transfer Paper Printable

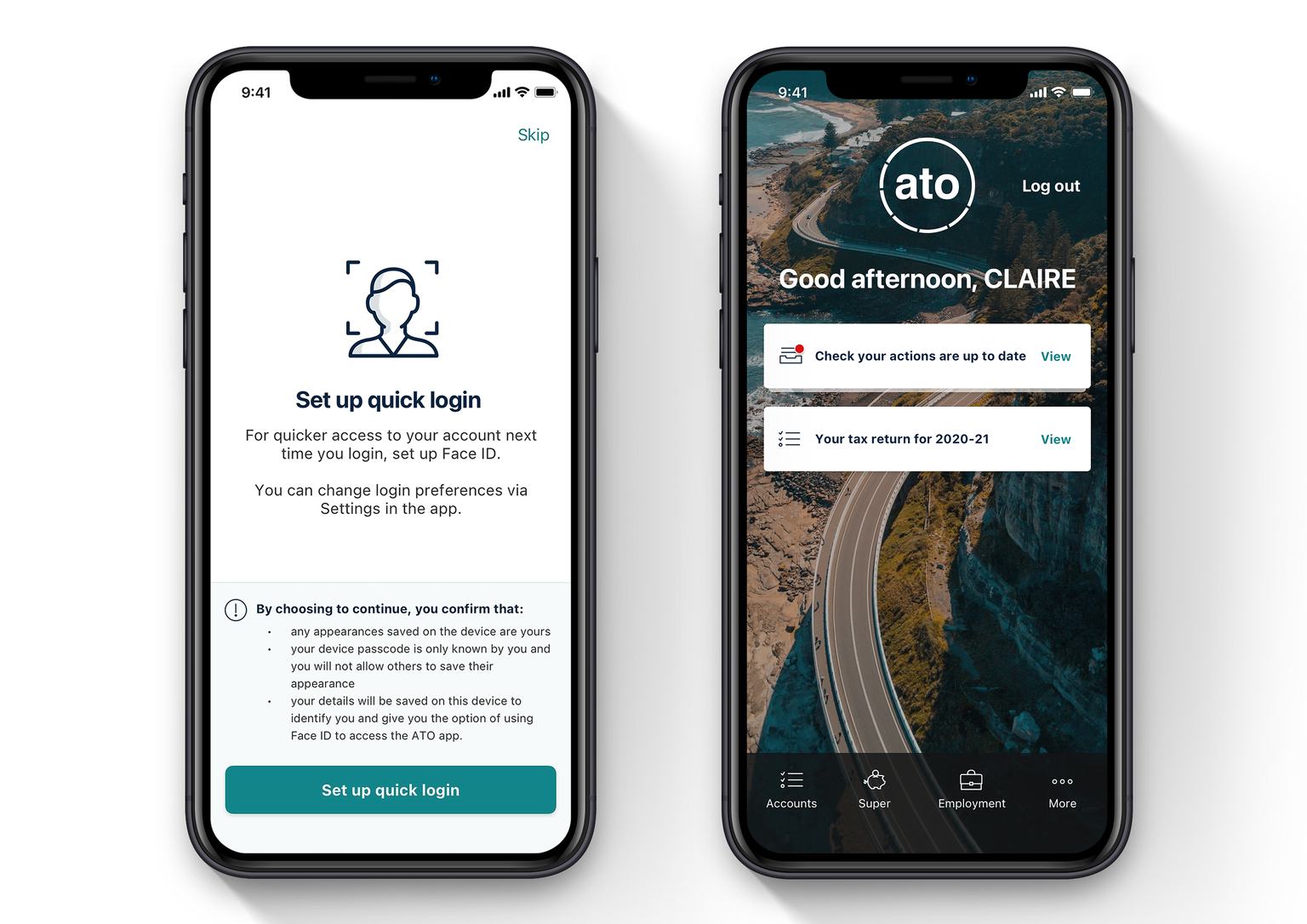

ATO App Making Tax Superannuation Easy Good Design

What Is Transfer In Tax Superannuation - How and when you move your superannuation from accumulation to pension phase will affect tax treatment and estate planning considerations